The CFPB is about to undo pretty much every piece of regulatory and sub-regulatory guidance its ever issued. https://public-inspection.federalregister.gov/2025-08286.pdf

#lawfedi #CFPB #ConsumerProtection

Recent searches

Search options

#cfpb

Thanks, Republicans!

New York watchdog warns Trump cuts will usher in ‘open season’ for scammers

https://www.theguardian.com/us-news/2025/may/08/brad-lander-cfpb-consumer-financial-protection

DOGE Aide Who Helped Gut CFPB Was Warned About Potential Conflicts of Interest

Before he helped fire most Consumer Financial Protection Bureau staffers, DOGE’s Gavin Kliger was warned about his investments and advised to not take any actions that could benefit him personally, according to a person familiar with the situation.

Other club owners, besides #DonaldTrumpJr, include Zach & Alex #Witkoff — the sons of #Trump’s #MiddleEast envoy #SteveWitkoff — & #OmeedMalik, who leads #1789Capital, a Florida-based #VC firm that recently *hired* Donald Trump Jr as a snr exec. The investments for 1789 Capital have included companies such as #Plaid, a #DigitalFinance firm that had lobbied the #CFPB related to a new set of banking rules—until Trump’s team effectively shut down the agency & stalled enforcement of the #regulation.

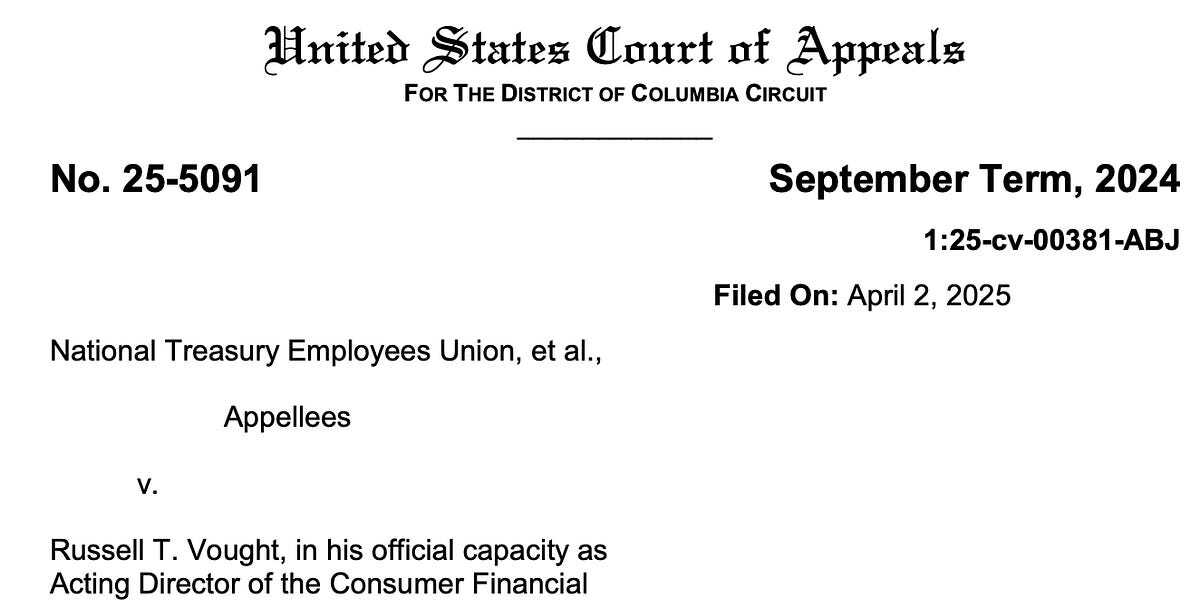

With an assist from @lawdorknews.bsky.social, I have updated my post from Wednesday about challenges to Russel Vought’s attempt to dismiss up to 90% of the CFPB’s employees. D.C. Circuit upholds the District Court’s stay on the action, with former White House counsel during Trump 1.0 joining the majority.

“Problems at DOGE continue to emerge. …the DOGE employee who is working to shrink the Consumer Financial Protection Bureau (CFPB), Gavin Kliger, owns stock in four companies the CFPB oversees.”

—Heather Cox Richardson, May 1, 2025

#gavinkliger #kliger #doge #cfpb

"A federal employee who is helping the Trump administration carry out the drastic downsizing of the Consumer Financial Protection Bureau owns stock in companies that could benefit from the agency’s dismantling, a ProPublica investigation has found.

Gavin Kliger, a 25-year-old Department of Government Efficiency aide, disclosed the investments earlier this year in his public financial report, which lists as much as $365,000 worth of shares in four companies that the CFPB can regulate. According to court records and government emails, he later helped oversee the layoffs of more than 1,400 employees at the bureau.

Ethics experts say this constitutes a conflict of interest and that Kliger’s actions are a potential violation of federal ethics laws.

Executive branch employees have long been subject to laws and rules that forbid them from working on matters that “will affect your own personal financial interest.” CFPB employees are also required to divest from dozens of additional, specific companies that engage in financial services and thus either are or could be subject to agency supervision, rulemaking, examination or enforcement.

The CFPB oversees companies that offer a variety of financial services, including mortgage lending, auto financing, credit cards and payment apps."

https://www.propublica.org/article/doge-consumer-financial-protection-bureau-gavin-kliger-stock

The Consumer Financial Protection Bureau has survived the first 100 days of the new Administration’s term with the help of Judge Amy Berman Jackson, who sees the latest RIF (correctly) as an attempt to prevent the CFPB from performing its statutorily-mandated functions

#law #contracts #CFPB #litigation #GovernmentEmployees #Injunctions

A DOGE Aide Involved in Dismantling Consumer Bureau Owns Stock in Companies That Could Benefit From the Cuts

—

Gavin Kliger helped oversee mass firings at the Consumer Financial Protection Bureau while holding stock in companies that experts say likely stand to benefit from dismantling that agency — a potential violation of federal ethics laws.

"A congressional watchdog agency is investigating Trump’s efforts to DISMANTLE THE CFPB, responding to Senate Dems who're also demanding that the agency’s Trump-appt acting dir turn over info about how the bureau can meet its statutory obligations amid attempts to lay off nearly 90% of its staff.

Courts have pushed back on the move, & an appeals court said Mon the admin couldn't engage in any mass layoffs at the bureau..."

#CFPB #Contempt #Lawlessness #Firings #USPol

https://amp.cnn.com/cnn/2025/04/29/politics/cfbp-cuts-gao-investigation

The latest in the #CFPB #litigation

For Judge Gregory Katsas, a #Trump appointee from the president’s 1st term, a month on the motions panel at the US Court of Appeals for the DC Circuit appears to have taught him an important lesson about Trump’s 2nd term.

#law #SeparationOfPowers #Judiciary

https://www.lawdork.com/p/the-education-of-judge-gregory-katsas

New Details on #Trump Sprint to Gut #Consumer Bureau Staff

Emails & testimonials from workers at the #CFPB document the admin’s efforts to lay off 90% of the employees.

2 wks ago, a 3-judge panel from the federal appeals court in DC lifted a freeze on firing employees at the CFPB, w/conditions. The judges…said that workers could be fired if agency leaders determined…that they were not needed to carry out the bureau’s legally required responsibilities.

#law #TrumpCoup

https://www.nytimes.com/2025/04/27/business/cfpb-layoffs-trump-musk-doge.html?smid=nytcore-ios-share&referringSource=articleShare&sgrp=p&pvid=12219B24-FE10-4CF9-B8C9-DA7678659E96

And that’s only a minuscule sampling. More obscure agencies, such as the recently gutted #CFPB, keep records of corporate trade secrets, #credit reports, #mortgage info, & other sensitive #data, including lists of people who have fallen on financial hardship.

A fragile combination of decades-old laws, norms, & jungly bureaucracy has so far prevented repositories such as these from assembling into a centralized American #surveillance state.

https://www.popularmechanics.com/cars/hybrid-electric/a64555334/tesla-class-action-lawsuit/

Uh-Oh, a Class-Action Lawsuit Claims Tesla Is Speeding Up Odometers to Avoid Warranties

Some thoughts about yesterday's Trump Executive Order that asserts that the "disparate impact" theory of liability for discrimination is unconstitutional. https://www.joshualawfirm.com/2025/04/trump-executive-order-disparate-impact/

Easy win for the CFPB over a man who ran a scammy credit-repair business. But nothing is easy these days for the administrative state. Given Jarkesy, is defendant entitled to a jury trial after the CFPB won a default judgment against his business entity?

"Ever since the CFPB was shepherded into law by Senator Professor Warren, it has returned over $21 billion to citizens from whom it had been bilked, swindled, grifted, and otherwise lifted by credit card companies, investment banks, student loan pirates, and other modern three-story men of the financial service industry."

https://www.esquire.com/news-politics/politics/a64527001/peter-marocco-firing-marco-rubio-usaid-maga/

#DOGE #Rubio #CFPB #ConsumerProtection #Fraud #Trump

Judge Amy Berman Jackson in Washington, DC, said the Trump administration could not move forward with the CFPB layoffs, which hit roughly 90 percent of the agency, until it presents more evidence about how the terminations have been carried out. https://www.wired.com/story/cfpb-terminations-paused-trump/